Double the Deals – Half the Time

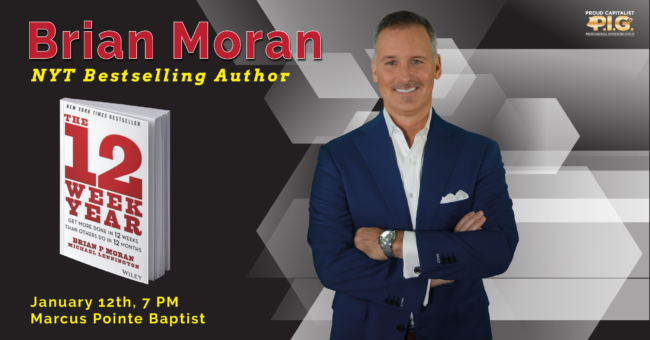

Click City Name for Meeting Location – All Meetings Begin at 7:00 PM Local Time PENSACOLA / ORLANDO – Tuesday, July 13th, 2021 — DESTIN / FWB – Thursday, July 15th, 2021 MOBILE – Monday, July 19th, 2021 — PANAMA CITY – Live Stream Only SAN ANTONIO – Tuesday, July 27th, 2021 . There is…